In part one of this series I laid out in detail the timeline of events leading up to, and through, the recent crisis in Cyprus. Part two delved into both the impact on regular depositors and small businesses as well as the unbelievable corruption that got Cyprus into this mess in the first place and the loopholes that allowed the elites to escape the financial carnage (even as ordinary Cypriots faced draconian capital controls).

I now want to focus on what comes next: The application of the Cyprus bail-in template to other EU countries as their banks fail. But first, let’s take a quick look at the state of the periphery of the EU and why more collapses are inevitable.

Are Things Really That Bad In the EU?

Yes, things really are that bad in the EU. Let’s forget about countries that have already completely capitulated (Ireland, Greece, Cyprus) and look briefly at just one of the prime candidates for collapse:

Spain

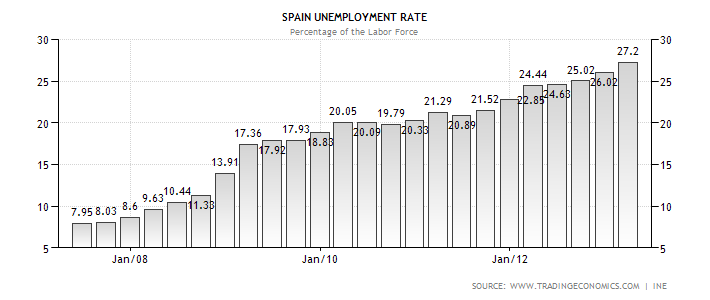

First, a couple of shocking charts about what’s happening in Spain. Let’s start with the official unemployment readings:

Yes, you’re reading that correctly: 27.2% official unemployment. This doesn’t even include the millions of Spaniards who long since gave up trying to find work (only people actively seeking employment are included in the official measure). And, it’s clear that unemployment is still trending up – it will get worse.

Yes, you’re reading that correctly: 27.2% official unemployment. This doesn’t even include the millions of Spaniards who long since gave up trying to find work (only people actively seeking employment are included in the official measure). And, it’s clear that unemployment is still trending up – it will get worse.

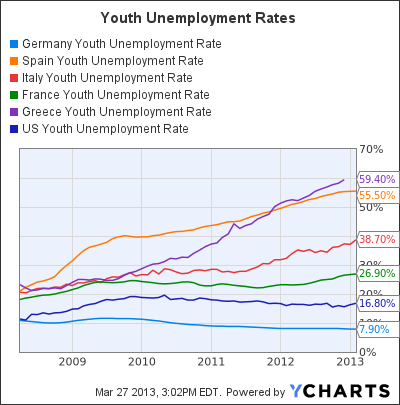

Think it couldn’t possible get scarier than that? Wrong. Check out what youth unemployment looks like:

In Spain over 55% of those 15-24 who are in the labour force and looking for work can’t find it. Note that students are not included in the measure.

In Spain over 55% of those 15-24 who are in the labour force and looking for work can’t find it. Note that students are not included in the measure.

And what about Spanish debt to GDP ratio? Surely all the austerity has gotten that under control, right?

Ouch! I don’t know about you, but that looks completely out of control to me. Even the politicians have revised the GDP estimate for 2013 to -1.3% and indicated that they expect unemployment well above 25% through 2014. I suspect the reality is much worse. Spain has been caught in the vicious austerity cycle I’ve talked about before: Austerity leading to increased unemployment which reduces tax revenue causing an increase in the debt to GDP ratio requiring more austerity.

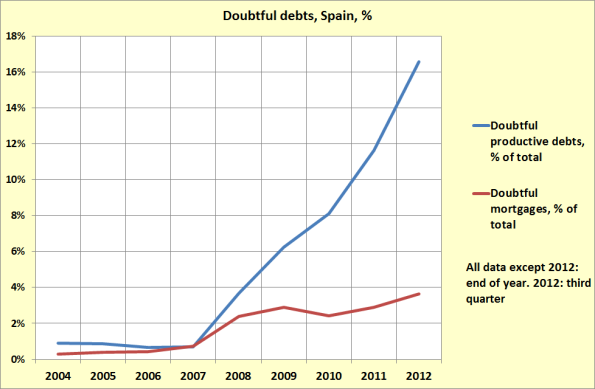

And what about the banks? While true bank risk tends to be highly obfuscated, some data is known. Bad loans (those loans behind or delinquent on payment and subject to loss) is one key metric used to assess the health of a banking system. But ‘healthy’ is not a word I’d use to describe the picture of Spanish bad loans:

But I hear some of my readers asking the legitimate question: But, if things are really so bad, why have Spanish bond yields (which breached 7% in the summer of 2012) been so tame lately and trading under 4.5%?

An excellent question. The answer to this is that, in the crisis of last summer, two actions were taken to drive down the run-away Spanish bond yields:

- The first was the announcement of the OMT (Outright Monetary Transactions) program by the ECB. This program, obfuscated with complexity, is really just the ECB buying distressed bonds to push down yields. This is the definition of monetization of debt.

- The second was the astonishing use of the Spanish national social security pension fund to purchase Spanish bonds. At this point, the pension funds has been completely raided with 97% of the fund used to buy domestic bonds. Any increase in bond yield (which would drive down the price of those bonds) will devastate the pension fund.

Note that both of these bond buying programs were aimed at circumventing the market price by creating artificial demand. It’s not that things in Spain have improved – as I showed above, the situation there is clearly continuing to deteriorate. Thus, the fall in Spanish bond yields is simply an exercise in can-kicking that has ensured that the pending disaster will be that much bigger.

And It’s Not Just Spain

No, it’s not just Spain. Far from it. I could run through a similar exercise showing how Slovenia, Italy, Luxemburg, Malta and several other peripheral countries are every bit as vulnerable to collapse as Spain. Heck, with the most recent numbers from France I could even put together a compelling argument that Hollande will very soon sufficiently destroy the French economy so as to put it at serious risk.

There are clearly many more dominos in the EU waiting to fall just like Greece and Cyprus. Will it be bail-in or bailout?

Cyprus IS the Template For Future Bank Crises

But don’t take my word for it. Here’s what Jeroen Dijsselbloem (Dutch Finance Minister, President of the Eurogroup and President of the Board of Governors for the European Stability Fund aka the EU bailout fund) had to say on March 25th as the final deal with Cyprus was announced:

If there is a risk in a bank, our first question should be ‘Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself?’. If the bank can’t do it, then we’ll talk to the shareholders and the bondholders, we’ll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders…

Bear in mind, Dijsselbloem was the lead negotiator for the EU during the Cyprus bailout talks. He does represent the opinion of the EU and would likely lead negotiations for future bailouts.

And, he further justified the Cyprus bailout as follows:

I’m pretty confident that the markets will see this as a sensible, very concentrated and direct approach instead of a more general approach…It will force all financial institutions, as well as investors, to think about the risks they are taking on because they will now have to realise that it may also hurt them.

You can find the whole transcript of the enlightening interview here. It’s worth a read. But, the main take-away is yes, the EU will use the Cyprus model as a template moving forward.

Of course, Dijsselbloem quickly found himself at the center of a firestorm once people started to react to that fact that their uninsured deposits were considered investments and would be confiscated in any future crisis. That same day (March 25th) he issued a clarifying written statement. Here’s that statement in its entirety:

Cyprus is a specific case with exceptional challenges which required the bail-in measures we have agreed upon yesterday. Macro-economic adjustment programmes are tailor-made to the situation of the country concerned and no models or templates are used.

Amazingly people seemed to simmer down after this two-line clarification was issued. First of all, this was clearly issued to prevent a massive uproar and even bank runs. Second, read the statement; It doesn’t say bail-ins would not be used moving forward, just that there is no template.

Not Confined to the EU

Think this risk is confined to the EU? Think again. In December of 2012 a report was released by the FDIC (Federal Deposit Insurance Corporation in the U.S.) and Bank of England titled ‘Resolving Globally Active, Systemically Important, Financial Institutions’. This paper discusses the plans for dealing with the too-big-to-fail banks when they become insolvent. Read the full report for yourself here if you’re interested but the main proposal is presented in paragraph 12:

12 Under the strategies currently being developed by the U.S. and the U.K., the resolution authority could intervene at the top of the group. Culpable senior management of the parent and operating businesses would be removed, and losses would be apportioned to shareholders and unsecured creditors. In all likelihood, shareholders would lose all value and unsecured creditors should thus expect that their claims would be written down to reflect any losses that shareholders did not cover. Under both the U.S. and U.K. approaches, legal safeguards ensure that creditors recover no less than they would under insolvency.

Thus, it all comes down to what an ‘unsecured creditor’ is since it is they that will be eating any losses after the shareholders are wiped out:

34 …But insofar as a bail-in provides for continuity in operations and preserves value, losses to a deposit guarantee scheme in a bail-in should be much lower than in liquidation. Insured depositors themselves would remain unaffected. Uninsured deposits would be treated in line with other similarly ranked liabilities in the resolution process, with the expectation that they might be written down.

So, clearly today’s planning for bank failures in the U.S. and UK have uninsured deposits subject to the same type of bail-in that happened Cyprus. It doesn’t matter which side of the pond you’re on – if you’ve got uninsured deposits in a bank you need to read this report and think long and hard about your risk tolerance.

And, there are similar documents and legislation springing up around the globe as the Cyprus style bail-in is acknowledged to be the model moving forward. New Zealand, as one example, currently has legislation before parliament to adopt a bail-in strategy. For Canadians this model is already law having been include in the recently passed 2013 Canadian budget (which will be the focus of my next post).

Not Confined to Bank Failures

And, it’s not just bank failures that carry the risk of deposit confiscation. Check out what Joerg Kraemer, the chief economist at Commerzbank, recently had to say about how to get Italy out of its sovereign debt crisis:

So it would make sense in Italy to raise a one-time wealth tax. A tax rate of 15 percent on financial assets would probably be enough to push the Italian government debt to below the critical level of 100 percent of gross domestic product.

Think this could never happen? The fact is these types of ‘capital levies’ have been used extensively in the past by many different countries. After both World War I and World War II levies were imposed through Europe and Asia as high as 50%. Even as recently as 1992 there was a small (0.6%) levy imposed in Italy with deposits withdrawn overnight. For a primer on the history of capital levies, check out this article.

So, there is a precedent for unilateral wealth confiscation by governments to combat financial crises. The worse the crisis, the higher the levies used to combat it. I would argue that the world today stands on the precipice of an unprecedented global financial meltdown. People should be losing sleep over the very real possibility of capital levies.

Get Your Money Out!

It should be obvious to anyone with a modicum of common sense that the precedent has been set. Certainly uninsured deposits are at risk of from bail-ins or capital levies. At a certain point I would suspect that even insured deposits will be at risk.

It amazes me that the events in Cyprus and subsequent statements out of the EU did not cause a full scale bank run in countries like Spain and Italy. What the heck are these people waiting for? Cyprus showed clearly that when the system fails it does so suddenly and with capital controls imposed. Further, there is clear historical precedent for capital levies to be imposed by these governments in times of crisis. Now is the time for these people to get their money out while they still can. The writing is on the wall – it doesn’t get more obvious. Learn from the suffering of the Cypriots – protect your assets!

You may also like:

- Anglo Irish Bank Tapes – Insight into Moral Hazard

The Anglo Irish tapes reveal how the bankers involved intentionally mislead regulators and the Irish government about the extent of the crisis. This was done to ensure the government would provide initial loans and then, having ‘skin in the game’, be forced to continue pouring in additional funds to prop up the bank. Ultimately this situation lead directly to the bankruptcy of Ireland and its entry into serfdom as a vassal of its masters at the EU and IMF.

- Bondpocalypse

The 30 year bull market in bonds is coming to an end. Attempts to keep the financial system from collapsing over the last five years have merely set the stage for a larger collapse. Government debts have exploded. Central banks have desperately lowered interest rates to near-zero and resorted to outright monetization of the debt. Recent events show us that the mere suggestion of possible future tapering is enough to cause an immediate and violent reaction in bond yields.

There’s no way out. The bondpocalypse come’th.

- Interest Rate Setting: Welcome to the Managed Economy

Were governments to raise all funding through taxes the people would revolt. Inflation provides a mechanism whereby people can be taxed without their knowledge or understanding. This currency debasement is only made possible due to the control of interest rates and the extent to which this is able to distort, obfuscate and manipulate the economy. We have allowed the State to eliminate the free market for the most important price that exists in a capitalist system: The price of money – interest rates. In so doing we consigned ourselves to a permanently sub-optimal economy.

No, we don’t have free market capitalism. Not even close. Welcome to the managed economy.

- The Cyprus Bail-In: Part Four – A Template for Canada

- The Cyprus Bail-in: Part Two – Impact and Corruption

- The Cyprus Bail-In: Part One – Timeline

Hi I’ve just started researching into the financial system this year and stumbled upon your site. I noticed there are no recent posts though :o( blogging anywhere else now?

I’ve stepped back from the blogosphere for the time being as a result of trying to get my business off the ground and time being in short supply. One day in the hopefully recent future I’ll resume posting on passionforliberty…