If I were to single out what for me would be the biggest risk to global financial stability right now it would be a disorderly reversion in the yields of government bonds globally, for any one of a variety of reasons. We have seen shades of that over the last two or three weeks. Let’s be clear, we have intentionally blown the biggest government bond bubble in history. That is where we are, so we need to be vigilant to the consequences of that bubble deflating more quickly than we might otherwise have wanted. That is a risk.

-Andrew Haldane, Executive Director of Financial Stability at the Bank of England, June 2013

You know it’s serious when the central bankers start preparing the public for the inevitable bondpocalypse. For Max Keiser acolytes the ideas explored in this post will be old news. For the rest, the goal is to shed light on what is arguably the largest systemic risk to the global financial system that exists. Indeed, the bond bubble that has been building over the last 30 years is arguably the largest bubble ever inflated and if it pops, which history indicates is inevitable, the financial carnage will be biblical.

Tale of Two Bond Bubbles

For reasons I’ll get to later, most major bond issuers have created bubbles. Let’s look at a couple of example bubbles to get a feel for the magnitude of what we’re talking about:

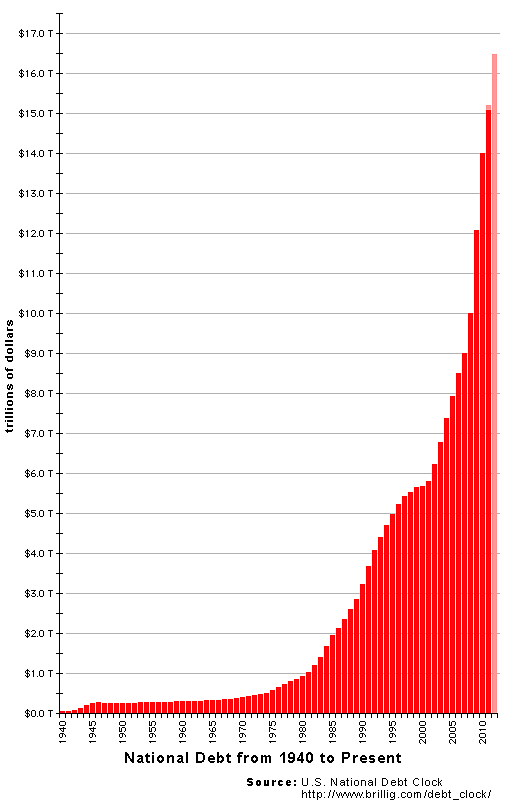

First off, outstanding U.S. government debt (which exists as bonds) not adjusted for inflation:

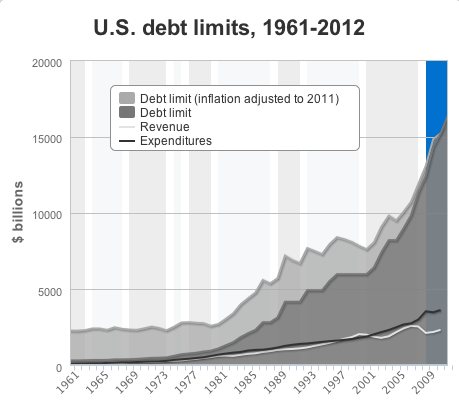

And, adjusted for inflation, the picture is still scary:

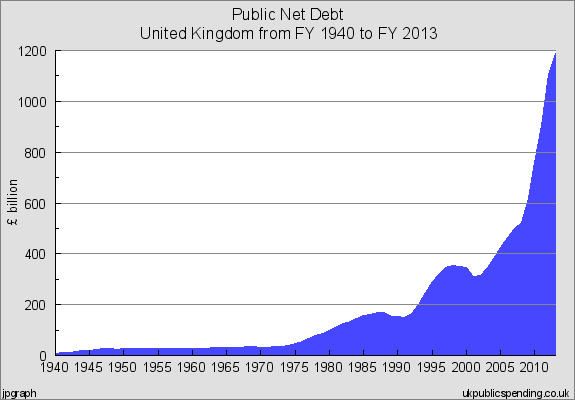

Next up, the outstanding U.K. government debt (also known as gilts):

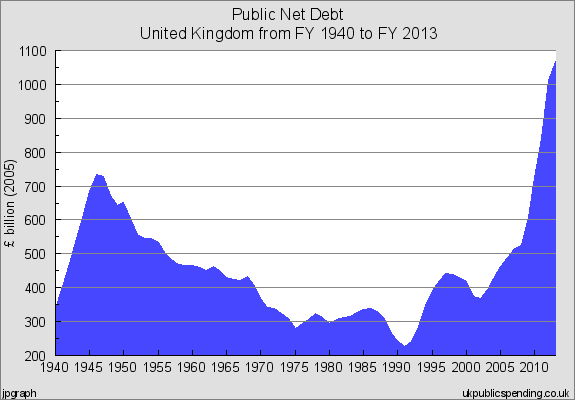

Inflation adjusted, the picture doesn’t get prettier:

These examples show what has happened in two of the largest bond markets that exist: U.S. and U.K. sovereign debt. In general, the markets for most other bonds have exhibited a similar explosive growth over the last few decades with marked acceleration in the last five years.

Clearly, the amount of total outstanding bonds has exploded. On the surface these bond markets certainly look like bubbles.

A 30 Year Bull Market in Bonds

How did things get to this point? For these bond markets to grow there needed to be two things: supply and demand.

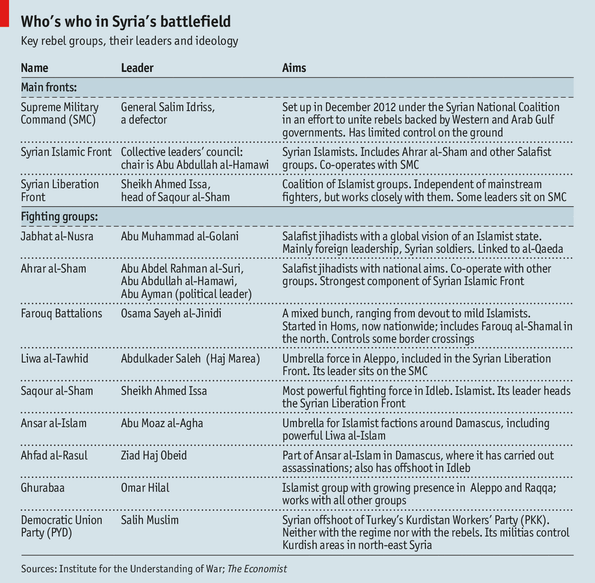

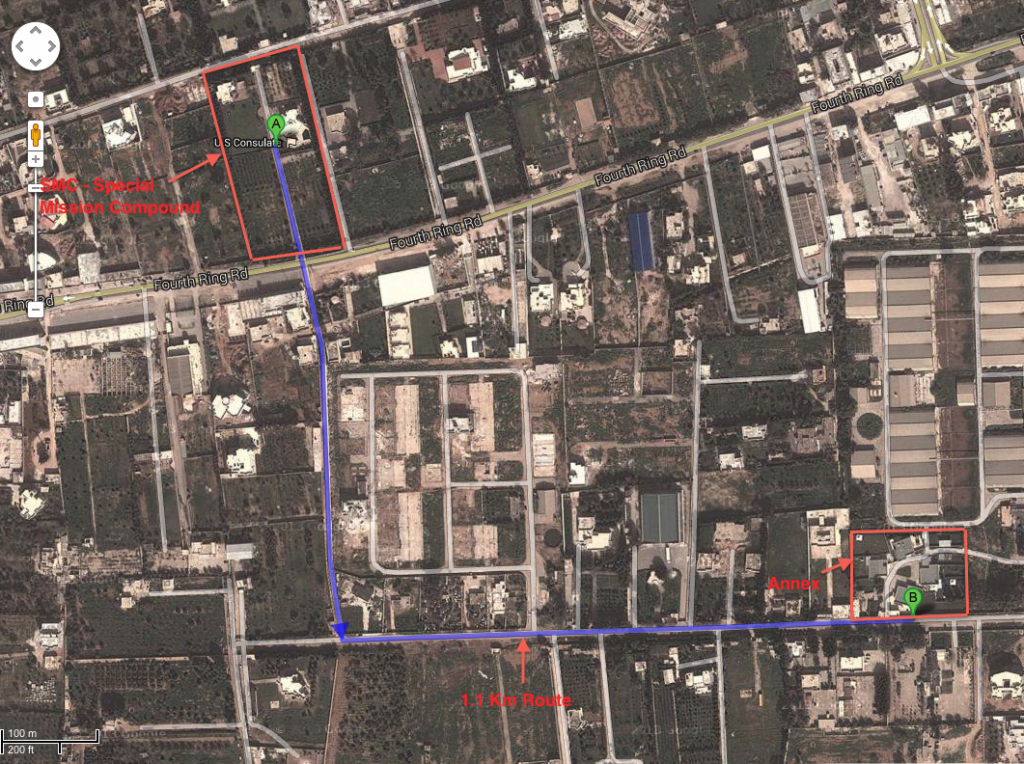

Understanding the additional supply is easy. Governments have been increasing in size for some time and are engaged in never ending and costly foreign entanglements (think Iraq, Afghanistan, Libya, soon to be Syria). To finance all this while servicing the interest on the pre-existing debt, governments have turned to issuing bonds like crazy. The financial crisis of 2008, which saw governments around the world take on huge debts to bail-out insolvent banks (signing up Joe Taxpayer to the banker’s gambling debts in the process), simply accelerated the growth of government debt.

Understanding the demand side requires a little more nuanced thinking.

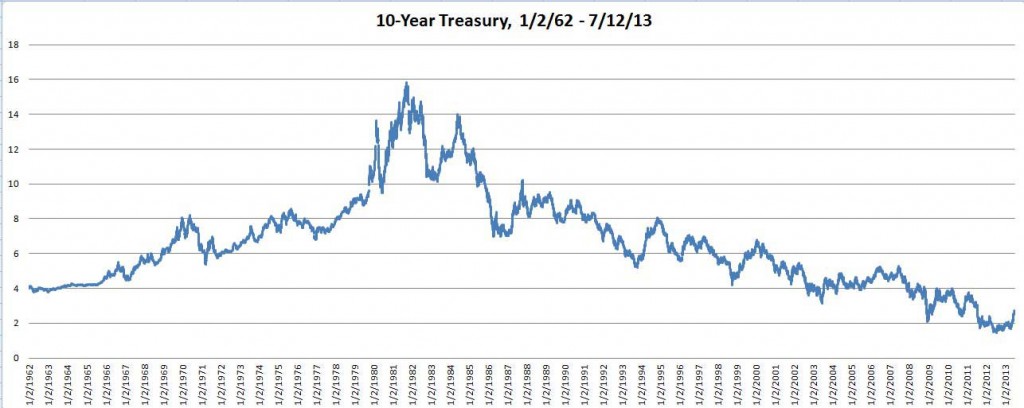

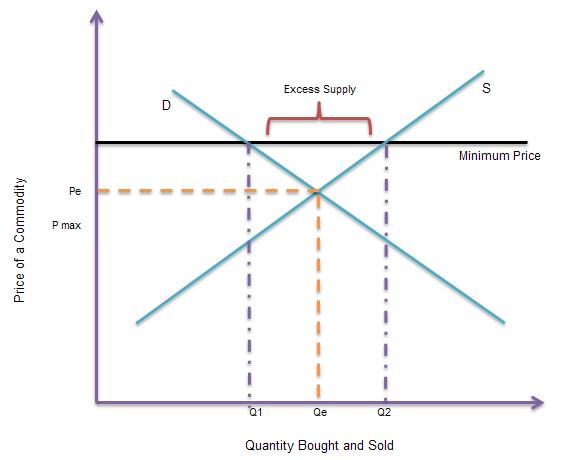

First of all, the primary enabler for this explosion of debt has been the interest rate policies of the central banks. That policy has been to gradually lower interest rates over the last 30 years. These interest rate policies get reflected directly in the interest (or yield) on government bonds. Here’s the U.S. 10 year bond yield from the 1960’s until today:

As you can see interest rates (set by the Fed) have been steadily falling since 1980. And, as bond yields fall, the price of bonds rise (see here for a good explanation of the inverse relationship between bond prices and yields). What does this mean? Basically, older bonds become more valuable and increase in price since they pay higher interest compared to new bonds being issued.

For the average investor holding a bond to maturity this change in price is irrelevant. After all, the investor will still collect the same amount for the bond when it matures. But large financial institutions, pension funds etc. often don’t hold their bonds to maturity. Instead, these bonds are traded on the open market with older, higher interest bonds fetching a premium over newer, lower interest bonds.

Thus, in a climate of lowering interest rates one can earn a profit by simply buying a bond, waiting for interest rates to fall, and then selling the bond. Indeed this is what the bankers have been doing over the last several decades. As long as rates continue on a downward trend, you’ve got yourself a bonafide money-making machine. The 30 year bull market in bonds has lead to a huge demand for bonds and allowed governments to get away with ever-larger debt bubbles.

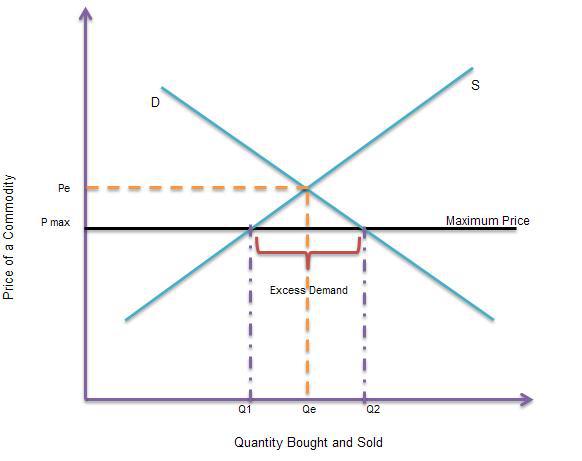

But, at a certain point one of two things happen which stop the party:

- The market is leveraged as high as possible and not able to generate a further increase in demand.

- Interest rates reach zero and cannot be reduced any further.

If either of these conditions occur, the money-making machine stops working. And, if either of these conditions reverse (interest rates rise or demand falls), bonds will enter a bear market of falling prices and increasing yields. The bubble pops.

Central bankers and government are, understandably, desperate to keep the wheels on the wagon. The problem is that, as it stands today, both of the above conditions have been breached. It’s likely that the bond market is, at this point, fully saturated. And, with the Federal Reserve already holding interest rates at less than 1%, there’s simply not room left to goose the markets with further interest rate cuts.

The Hail Mary Play: Monetize the Debt

But the central bankers have one last tool they are using to try and keep the bond market from collapsing: Debt monetization.

In general it’s frowned upon for central banks to simply outright purchase and hold government bonds. The reason is simple: Such a monetization of the debt essentially gives the government a free-reign to raise all the funds it desires. In our short-term, highly corrupt political system this is obviously a very dangerous tool.

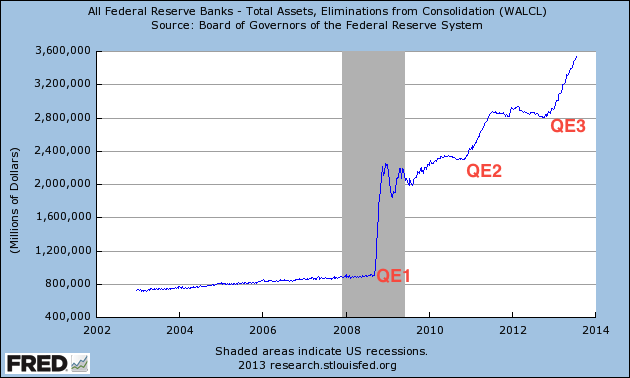

But this kind of outright debt monetization is exactly what’s been happening for the last several years. Various incarnations of Quantitative Easing (QE) have occurred which all basically boil down to the same thing: The Fed buying U.S. bonds and mortgage backed securities and holding them long-term on its balance sheet. Here’s what the Fed’s holdings look like for the last 10 years:

As you can see, the Fed’s balance sheet has quadrupled in size in just five years. And, the Fed is continuing with their QE3 (aka QE-Infinite) program of buying $85 billion a month of U.S. bonds and mortgage backed securities. As a result, the scary looking QE3 slope can simply be extrapolated into the future. It’s not hard to see where we’re going. This represents the outright and long-term monetization of the debt not to mention the absorption of toxic mortgage backed securities left over from the subprime crisis.

What Happens If the Fed Stops

Clearly the Fed’s QE programs have injected huge amounts of artificial demand into the bond market. This, coupled with near zero interest rates have allowed the party in the bond market to continue just a little while longer. But the Fed is playing with fire and they know it. The danger: Inflation.

The Fed can’t simply keep increasing the monetary base forever at this pace. At some point all the digital money printing must show up as inflation. Up until now the decelerating velocity of money as credit markets tighten has masked the underlying increase in the supply of money. But at some point this will change. And, if history tells us anything, it’s that once the inflation genie is out of the bottle it can be very difficult to put back in. In the late 70’s and early 80’s Fed chairman Paul Volcker had to jack interest rates north of 20% to tame runaway inflation.

So what happens when the Fed stops QE3? Or worse, what happens when the Fed starts to unload the assets on its balance sheet back into the open market (which it assures us it’s going to do)?

Simple: The bond bubble will burst. There’s just no way around it. Once the conditions that created the 30 year bull market in bonds are stopped, demand for bonds will fall. At the same time governments are saddled with truly historic debt loads that must be serviced (requiring the creation of an ever larger supply of debt). Increasing supply and decreasing demand for an asset will inevitably cause the price for that asset to plunge. Pop goes the bubble.

To put an exclamation mark on this consider what’s happened since May 2013 when Fed chairman Ben Bernanke indicated that a tapering of QE3 might commence towards the end of 2013:

This drastic increase from around 1.7% to 2.7%, a more than 50% rise, resulted from just the mention of a possible future tapering. And, during this period the Fed artificially goosing demand by buying $85 billion a month in assets. Just imagine the carnage if the Fed actually does taper and unload all the treasuries sitting on their balance sheet back into the market.

And what about the real impact of these increased yields? It’s not just that prices will plunge hitting bank capitalizations, pension funds and the like. These bond yields represents the amount it costs for governments to borrow. If the yields spike up sharply so too does the amount of interest required to service all that debt that’s accumulated in the last 30 years. This will very quickly become unsustainable especially for countries already teetering on the brink of insolvency (Spain and Italy leap to mind).

Watch Out For Bank Failures

It’s not just governments that are highly exposed to increasing bond yields. Banks hold large quantities of ‘safe’ government bonds on their balance sheets. These bonds contribute to the reserve requirements (capitalization) of the banks. But, if the price of these bonds fall, banks can very quickly find themselves under-capitalized and at risk of failure.

This is something I believe we are going to see once the bubble pops: Systemic bank failures. God help us if the governments do what they did in 2008 and bailout these reckless and over-leveraged banks using debt guaranteed and owed by the tax-payer. Of course, the flip-side, a Cyprus style bail-in in which depositors are forced to pay amounts to the same thing.

In either scenario the little guy is going to have to bend over and take it. Individuals would be well advised to take steps to protect their investments against the threat of inflation and confiscation.

The Bondpocalypse Come’th

The 30 year bull market in bonds is coming to an end. Attempts to keep the financial system from collapsing over the last five years have merely set the stage for a larger collapse. Government debts have exploded. Central banks have desperately lowered interest rates to near-zero and resorted to outright monetization of the debt. Recent events show us that the mere suggestion of possible future tapering is enough to cause an immediate and violent reaction in bond yields.

There’s no way out. The bondpocalypse come’th. With it will come a one-two punch of a massive increase in the cost to service national debts coupled with massive losses in the financial system which could well lead to wide-spread bank failures.

Rather than let the system collapse or institute the deep structure reforms necessary, governments will likely resort to ever increasing debt monetization. The result to these debt based policies must be inflation.

Protect yourself. Prepare yourself. Things are going to get ugly.